Table of Contents

Why You Need a Detailed Wedding Budget Breakdown Before Spending a Dime

Creating a detailed wedding budget breakdown is essential before you start spending money on your special day. Going into wedding planning without a clear understanding of your expenses can lead to financial stress and potentially ruin the experience. In 2026, inflation factors will likely play a significant role in wedding expenses, making it even more crucial to have a solid plan in place.

According to industry statistics, the average wedding cost has increased by 10 15% in the past year alone. Without a budget breakdown, you risk overspending on certain aspects of the wedding and neglecting others. A well planned wedding budget breakdown will help you prioritize your spending, ensure that you have enough money for the things that matter most to you, and avoid any last minute financial surprises.

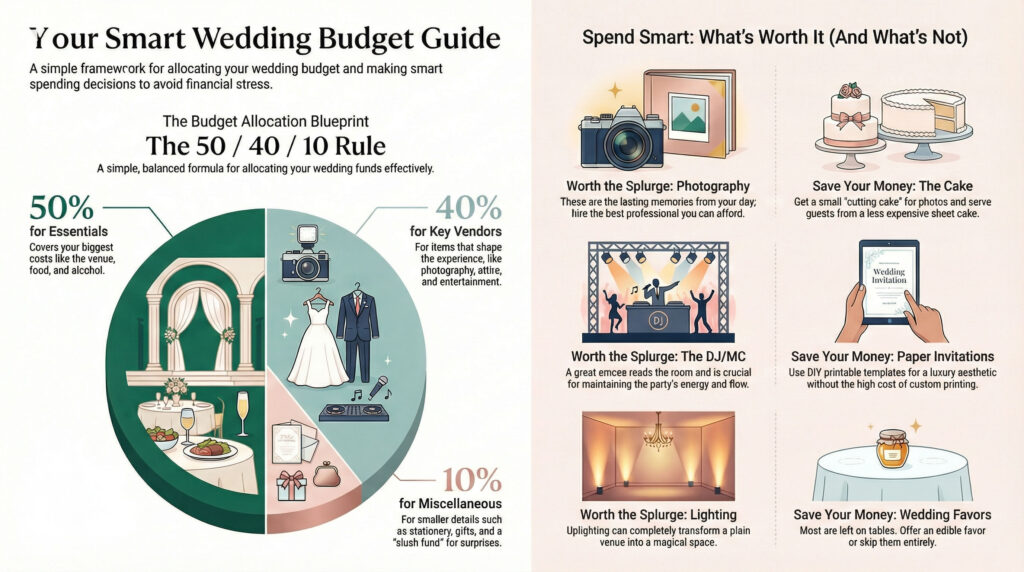

Where Does the Money Actually Go? The 50/40/10 Rule

The 50/40/10 rule is a widely accepted formula for allocating wedding expenses. This rule suggests that 50% of your budget should go towards essential expenses such as venue and catering, 40% towards discretionary spending like photography and attire, and 10% towards miscellaneous costs like gifts and favors. To apply this rule to your wedding planning, use our Free Wedding Budget Calculator to get an instant breakdown of your expenses. This will give you a clear picture of where your money is going and help you make informed decisions about your spending. By following the 50/40/10 rule, you can ensure that your wedding budget breakdown is balanced and that youre allocating your resources effectively.

Stop guessing using generic templates. Input your exact budget into our Free Wedding Budget Calculator to get your personalized breakdown in seconds

Detailed Expense Allocations: A Category-by-Category Guide

Breaking down your budget isn’t just about assigning percentages; it’s about knowing exactly what those numbers buy you in the 2026 wedding market. Here is a deep dive into each category with actionable tips to maximize your ROI.

Venue & Catering (40-50%)

This is your biggest ticket item. This category includes the rental fee, food, alcohol, service staff, and often the cake. In 2026, average venue costs have risen, so locking this down early is key.

- What to expect: For a $30,000 budget, you are looking at allocating about $12,000 – $15,000 here.

- Smart Save Tip: Consider a “Friday” or “Sunday” wedding. Venues often offer 15-20% discounts for non-Saturday dates. Also, opt for a buffet or “family style” service instead of a plated dinner to save on staffing costs.

Photography & Videography (10-12%)

Your photos are the only thing that lasts after the day is over. Do not skimp here.

- What to expect: Expect to pay $3,000+ for a reputable photographer.

- Smart Save Tip: If videography is out of budget, hire a “Content Creator” for social media clips instead of a full cinema crew, or book your photographer for 8 hours instead of the full 12.

Stationery & Paper Goods (2-3%)

This includes Save the Dates, Invitations, Programs, Menus, and Thank You cards. This is one of the easiest categories to control.

- Where to Splurge: High-quality paper stock (cotton or heavy cardstock).

- Where to Save: Use DIY Printable Templates. Instead of paying $10 per invite for custom letterpress, you can buy a premium template for $15, print it at home or a local shop, and pay less than $2 per invite. This creates a high-end look for a fraction of the price.

Flowers & Decor (8-10%)

Fresh flowers have skyrocketed in price due to transport costs.

- Smart Save Tip: Repurpose your ceremony flowers (arch/aisle markers) for the reception. Use plenty of candlelight (which is cheap) to create mood instead of massive floral centerpieces. Also, verify check our Signage Templates to create professional looking welcome signs without the custom acrylic price tag.

Attire & Beauty (8-10%)

Don’t forget to budget for alterations! A $2,000 dress often requires $400-$600 in tailoring.

Music & Entertainment (8-10%)

A DJ is generally cheaper ($1,500 – $2,500) than a live band ($4,000+). A good DJ acts as your emcee and keeps the flow moving.

How to Track Your Wedding Budget: Spreadsheet vs. Apps

You cannot manage what you do not measure. In the chaos of planning, receipts get lost and mental math fails. You need a centralized system.

Why Apps Fail: Most free apps are trying to sell you vendors. They are cluttered with ads and generic checklist items that don’t apply to you.

Why Spreadsheets Win: A spreadsheet is fully customizable. You can add columns for “Paid,” “Due Date,” and “Who is Paying.” It does the math for you and works even when you have no wifi.

The Ultimate Solution: We have built a Master Wedding Budget Spreadsheet that combines the 50/40/10 rule with a tracker. It auto-calculates your remaining balance and visually warns you if you overspend in a category.

Get Your Budget Under Control Today

Don’t start spending until you have a plan. Download our free tool now. Download the Master Spreadsheet →

What’s Actually Worth the Splurge? (And What’s Not)

Not all wedding expenses are created equal. After analyzing thousands of weddings, here is the brutally honest truth about where your money matters and where it doesn’t.

WORTH THE SPLURGE

- Photography: Ten years from now, the cake is eaten and the flowers are dead. The photos are all you have left. Hire the best pro you can afford.

- The DJ/MC: A bad DJ kills the party faster than bad food. You need a pro who can read the room, not just a Spotify playlist.

- Lighting: Up-lighting can transform a boring hotel conference room into a magical ballroom for a fraction of the cost of expensive decor.

SAVE YOUR MONEY (DO THIS INSTEAD)

The Cake: Order a small “cutting cake” for photos and serve sheet cake from Costco (hidden in the kitchen) to the guests. It tastes exactly the same and saves 60%.

Invitations (The Paper Trap): Do not spend $1,500 on paper that gets thrown in the trash. Use DIY Printable Templates. You get the same luxury aesthetic for $50-$100 total. No one will know the difference.

Favors: Most personalized koozies and candles get left on the tables. Skip them or do something edible (like a cookie).

Champagne Toast: Most people take one sip and leave it. Let guests toast with whatever drink they already have in hand. This saves roughly $5 per person.

Money Talk: How to Discuss the Budget with Your Partner & Family

Discussing the budget with your partner and family can be a sensitive topic, but its essential to ensure that everyone is on the same page. Here are some tips for having the conversation: Be open and honest about your finances and expectations Set clear boundaries and priorities Consider having a joint budgeting meeting with your partner and family to discuss expectations and allocations Be respectful and understanding of each others perspectives and priorities By having an open and honest conversation about your wedding budget breakdown, you can ensure that everyone is aligned and that your special day is memorable and enjoyable for all.

12 Hidden Wedding Costs to Watch Out For

You’ve budgeted for the venue and the dress, but what about the “ghost” expenses? These are the sneaky costs that no one tells you about until the bill arrives. In 2026, these hidden fees can easily add up to 15% of your total budget.

1. Postage & Stamps (It’s not just $0.66!)

You forget that an invitation set with multiple cards (RSVP, Details, Map) is heavy. Expect to pay double or triple standard postage per envelope. Plus, don’t forget the stamps for the RSVP return envelopes—yes, you have to pay for those too!

2. Wedding Dress Alterations

The sticker price on the dress is just the beginning. The average bride spends between $400 and $900 on alterations alone (hemming, bustling, taking in the bodice). Always budget this on top of the dress price.

3. Vendor “Vendor Meals”

Your photographer, videographer, and DJ are human—they need to eat during your 8-hour reception. Most contracts require you to provide a hot meal for them. Ask your caterer for “vendor meal pricing” (usually 50% of a guest meal).

4. Service Charges & Tips (The Big One)

A “Service Charge” (often 22-25%) is NOT a tip. It’s an administrative fee kept by the venue. You are often expected to tip staff on top of that. Always read the fine print.

5. Cake Cutting Fees

If you bring a cake from an outside bakery, many venues charge $2-$5 per slice just to cut and plate it. Pro Tip: Setup a cupcake tower or donut wall to avoid this fee entirely!

6. Overtime Costs

If the party is bumping and you want the DJ to stay “just one more hour,” be prepared to pay premium overtime rates (often double the hourly rate) for the venue staff, security, and vendors.

7. Delivery, Setup, and Breakdown Fees

The florist doesn’t just teleport the flowers to the tables. There are significant labor fees for driving the van, setting up the arch, and coming back at 1 AM to tear it all down.

8. Marriage License

It’s a legal requirement, but often forgotten in the budget. Depending on your state, this can cost anywhere from $30 to $100.

9. Pre-Wedding Beauty Treatments

Hair and makeup on the day of are usually budgeted, but what about the trials? A trial run costs nearly as much as the actual day. Plus, add in months of facials, spray tans, and manicures leading up to the event.

10. Welcome Bags Delivery

Many hotels charge a fee ($3-$5 per bag) just to hand them out to your guests at check-in. Ask the hotel manager to waive this if you are booking a large room block.

11. Non-Approved Vendor Fees

Some venues have an “Exclusive Vendor List.” If you really want that specific photographer who isn’t on their list, you might have to pay an “Outside Vendor Fee” to bring them in.

12. Cleanup & Trash Removal

Especially for DIY venues or backyards: Who takes out the trash at the end of the night? If the venue doesn’t cover it, you’ll need to hire a cleaning crew or lose your security deposit.

Real Wedding Budget Examples $20k, $35k, $60k

To give you a better idea of how the same breakdown can look on different total amounts, lets consider three real wedding budget examples:

| Budget | Venue & Catering | Photography & Videography | Attire & Beauty | Flowers & Decor | Music & Entertainment | Stationery |

|---|---|---|---|---|---|---|

| $20,000 | $8,000 $10,000 | $2,000 $2,400 | $1,600 $2,000 | $1,600 $2,000 | $1,600 $2,000 | $400 $600 |

| $35,000 | $14,000 $17,500 | $3,500 $4,200 | $2,800 $3,500 | $2,800 $3,500 | $2,800 $3,500 | $700 $1,050 |

| $60,000 | $24,000 $30,000 | $6,000 $7,200 | $4,800 $6,000 | $4,800 $6,000 | $4,800 $6,000 | $1,200 $1,800 |

As you can see, the proportions of the budget allocated to each category remain relatively consistent, regardless of the total budget.

Understanding These Budgets

The $20k “Savvy” Wedding: This budget relies on creativity. You’re likely looking at a Sunday wedding, a buffet dinner, minimal fresh flowers (heavy on greenery), and definitely using printable stationery. The guest list is capped at 70-80 people.

The $35k “Standard” Wedding: This allows for a Saturday date at a mid-range venue. You can afford a professional DJ, a plated meal (chicken/fish), and a decent flower budget. Guest count is around 100-120.

The $60k “Premium” Wedding: This unlocks top-tier vendors. Think live band, open top-shelf bar, intricate floral installations, videography, and a prime Saturday night venue. Guest list can expand to 150+ comfortably.

FAQ: Your Burning Wedding Budget Questions Answered

Still have questions about managing your finances? Here are the most common questions couples ask in 2026.

Who pays for the wedding in 2026?

The days of the “bride’s family pays for everything” are largely over. In 2026, the most common scenario is a collaborative effort. Typically, the couple pays for about 45-50% of the wedding themselves, with parents on both sides contributing the rest. It is crucial to have this conversation early to avoid assumptions.

How much should we save per month?

Start by taking your total estimated budget minus any contributions from family. Divide that number by the months left until your wedding. For example, if you need $15,000 and have 15 months, you need to save $1,000/month. We recommend setting up a separate high-yield savings account just for the wedding to keep these funds safe.

Is a cash bar tacky?

In modern etiquette, asking guests to pay for their own drinks is generally frowned upon, especially if they have traveled to be there. If an open bar is out of budget, opt for a “Consumption Bar” (you pay only for what is opened) or serve only Beer, Wine, and one Signature Cocktail to keep costs down while still being a gracious host.

Do bridesmaids/groomsmen pay for their own attire?

Yes, traditionally the wedding party pays for their own dresses and suits. However, as the couple, you should be mindful of their budgets. If you require a specific $300 dress, be prepared for some pushback. A great gesture is to cover the cost of their hair/makeup or accessories as a thank-you gift.

What is a “Slush Fund” and do I need one?

A Slush Fund is a safety net for unexpected costs. You should absolutely earmark 5-10% of your total budget for emergencies (like a sudden tent rental due to rain or last-minute alterations). If you don’t use it, great! You have extra cash for the honeymoon.

What is the most expensive part of a wedding?

The Venue and Catering combined will always be your biggest expense, consuming 40% to 50% of your total budget. If you need to cut costs significantly, trimming the guest list (which lowers your food/drink bill) is the most effective way to do it